- Junta launches major offensive to retake strategic Mawchi mining town

- Extreme poverty drives Sittwe residents to dismantle abandoned houses for income

- Weekly Highlights from Arakan (Feb 23 to March 1, 2026)

- Over 300 political prisoners freed from 10 prisons nationwide

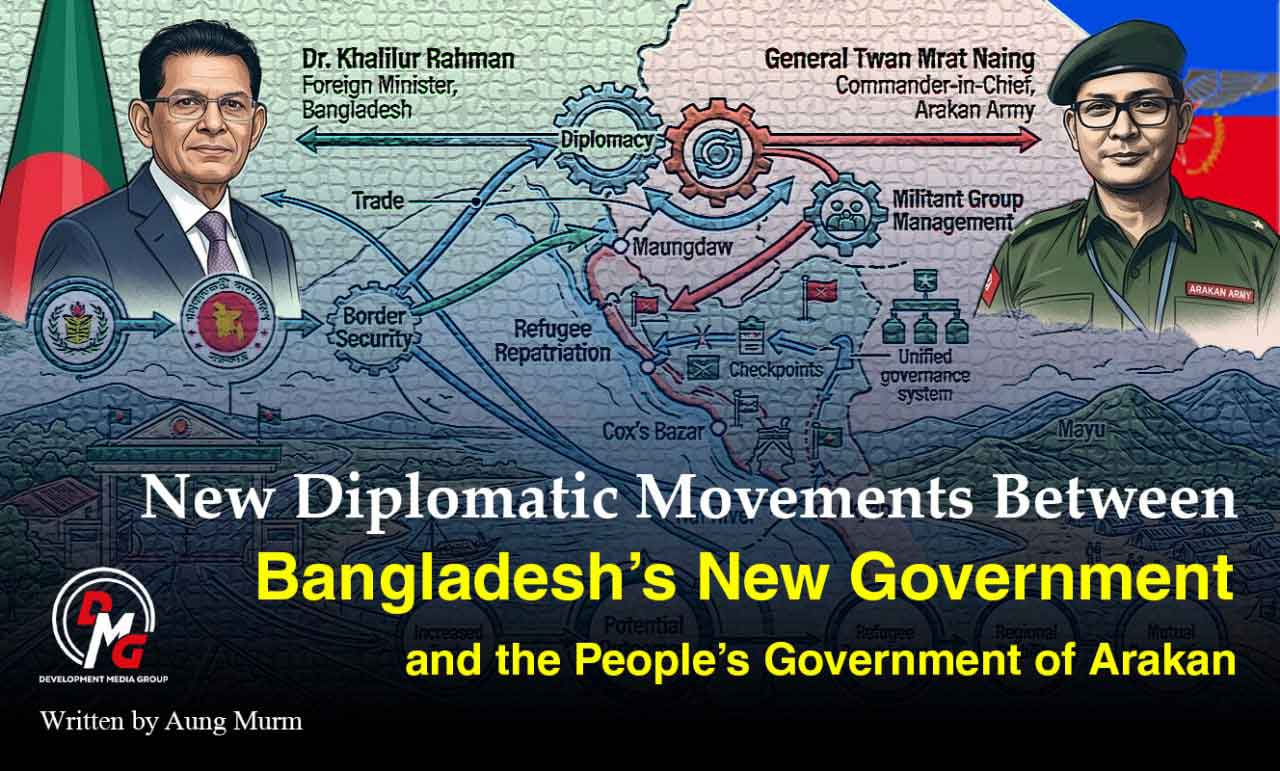

- DMG Editorial: Between War and Opportunity - A New Border Reality for Bangladesh and Arakan

Agricultural loans show marked decline as Arakan farmers struggle with rising costs

The number of local farmers in Arakan State who have access to agricultural loans provided by the state-owned Myanmar Agricultural Development Bank has declined year after year since 2020, according to a bank official.

05 Jul 2022

DMG Newsroom

5 July 2022, Sittwe

The number of local farmers in Arakan State who have access to agricultural loans provided by the state-owned Myanmar Agricultural Development Bank has declined year after year since 2020, according to a bank official.

Agricultural loans this year have been disbursed to local farmers since May 15, but loans are provided only to those who have paid back the previous year’s loans. Many farmers are unable to pay back their loans from the year prior, manager U Ba Kyaw Sein of the Arakan State branch of Myanmar Agricultural Development Bank told DMG.

Around 12,600 farmers from Arakan State’s 17 townships have been provided with about K847 million worth of loans, according to U Ba Kyaw Sein.

“We initially earmarked 4 billion kyats to provide loans to farmers. But only a small number of farmers paid back their loans from the previous year,” he said.

More than 80,000 farmers applied for agricultural loans in 2020, and some 30,000 paid back those loans. Those 30,000 farmers were given agricultural loans last year, but less than half repaid their 2021 loans.

Many farmers are unable to pay back their loans due to increases in the prices of agricultural inputs such as fertiliser, and increased labour and fuel costs.

“We could not fertilise properly last year due to soaring fertiliser prices,” said farmer U Hla Maung Thein from Pauktaw Pyin village, Mrauk-U Township. “As a result, the harvest was not good, and consequently, we were not able to pay back loans. We also suffered from bad weather and flooding, which negatively affects output. So, we can’t apply for agricultural loans this year.”

Farmers who have paid back their 2021 loans and received new loans for this year have also reported difficulties, saying they only continue to engage in farming because it is their traditional livelihood.

“I have paid back last year’s loans,” said farmer U Soe Thein from Tin Nyo village in Mrauk-U Township. “But the prices of fertiliser and fuel have increased this year, and we have a lot of difficulties. Nonetheless, we have no other option.”

The bank provides loans of K150,000 per acre for a maximum of 10 acres, at a monthly interest rate of five kyats per K100,000.

More than 800,000 acres of farmland were put under paddy cultivation in Arakan State last year, and sown acreage declined by 100,000 acres this year due to the increased costs of agricultural inputs.

U Kyaw Zan, chairman of the Arakan Farmers Union, called on the government to sell fertiliser at artificially low prices for local farmers in Arakan State.

“There are many difficulties for farmers as the prices of fertiliser and fuel have increased this year. Some tenants are not growing paddy this year. The government needs to sell fertiliser at low prices to solve this,” he said.

The price of a sack of fertiliser has hit more than K130,000 in Arakan State. Two years ago, a sack of fertiliser cost between K25,000 and K35,000.